As it stands, the future of cryptocurrencies appears to be a multi-chain world with a variety of coexisting ecosystems. The creation of cross-chain infrastructure will be essential for bridging compartmentalized blockchains in this anticipated scenario. Atomic swap technology has thus far demonstrated potential for changing decentralized cryptocurrency trading. A blockchain that supports each cryptocurrency was created specifically to allow transactions in that currency. For instance, ETH (ether) and Bitcoin (BTC) both have blockchains. BTC and ETH cannot be easily exchanged without first converting to fiat currency and then purchasing the other; an alternative method is to switch between cryptocurrencies and exchanges numerous times to obtain the desired cryptocurrency. With atomic swaps, you can exchange tokens from various blockchains in a single transaction.

In this article we’ll discuss what Atomic swap is, why it is important, how it works, benefits and downsides of using Atomic swap.

What is an atomic swap

An atomic swap is the exchange of coins from different blockchains. Without the intervention of a third party, the exchange is carried out between two entities. The goal is to give token owners complete control by doing rid of centralized intermediaries like regulated exchanges.

In a “atomic state,” there are no substates; something either occurs or it doesn’t; the term “atomic” comes from this concept. This refers to the transaction’s status, whether it occurs or not.

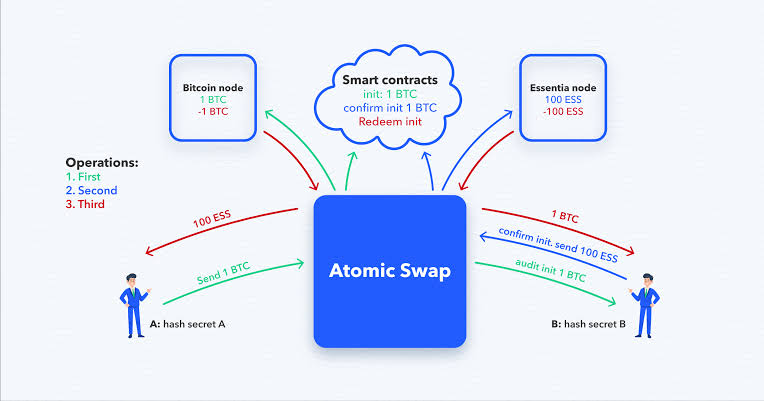

Smart contracts are used by the majority of atomic swap-capable blockchains. Blockchain-based smart contracts are programs that run when specific criteria are met. In this instance, the requirements are that both parties accept the transaction before a timer expires. By using a smart contract, neither side may take cryptocurrency from the other during the transaction.

This kind of trustless exchange is a crucial component of trade in decentralized finance (DeFi). DeFi transactions take place directly on-chain, without the aid of a middleman.

Why are atomic swap important

Atomic Swaps address the problems with using centralized finance (CeFi) to exchange coins.

Imagine that you want to use a controlled exchange (CEX) to convert your ETH from Ethereum to BTC from Bitcoin. You would probably need to follow a complicated set of steps, such as: establishing a user account on a centralized trading platform using the ETH/BTC pair, sending ETH outside of the blockchain to the main exchange, ETH to BTC exchange (including transaction costs), BTC withdrawal (and additional costs) to a Bitcoin wallet. Waiting for the exchange to complete your transaction and eventually get funds.

Ultimately, using this strategy leads to transactions that are both expensive and difficult.

Along with being inefficient, CEXs might raise unforeseen security issues with relation to custody. Wallets containing private keys that belong to the exchange are used by centralized trading platforms to store user monies. Users don’t actually have complete custody of their assets, so this means. Your bitcoin may be at risk in the event of a security breach or withdrawal freeze. On the other hand, DeFi can be utilized with decentralized wallets, where users own all of their cryptocurrency and are the only ones with access to their private keys.Overall, relieving users of cryptocurrencies of unnecessary processes and several potential security threats by eliminating the need for a “middle-man” in trade.

How Do Atomic Swaps Work?

Hashed Time Lock Contracts (HTLCs), a kind of smart contract, are used in atomic swaps to enable a trustless exchange of digital assets. Once all of the preset conditions encoded inside the contract are satisfied, a smart contract employs an automated procedure that self-executes.

Two essential elements that are encoded in the HTLCs of Bitcoin make it feasible for atomic swaps to occur:

Hashlock. A hashlock is a secret key created by the person who started the transaction that is cryptographically hidden. This key makes sure that swaps are only completed after both parties have given their consent.

Timelock: Timelocks are created using the Check-Lock-Time-Verify (CLTV) or Check Sequence Verify (CSV) commands. With CLTV, a transaction’s funds are locked or released based on the date and time. With CSV, money is either locked or released when a specified number of blocks are produced. Timelocks, to put it simply, establish a deadline for swaps. The timelock functions as a safety feature, nullifying the transaction if both parties do not agree to the exchange before a predetermined time. In this case, the money will be returned to the owners.

Advantages of atomic swap

1.increased interoperability. The possibility of connecting various blockchains is made possible through atomic swaps.

2.completely decentralized. The core principles of blockchain technology and cryptocurrencies—programmability, immutability, and autonomy—are built upon via atomic swaps. Users are able to maintain full custody of their wallet, its private keys, and the tokens stored inside thanks to smart contracts and the blockchain.

3.Inexpensive. Atomic swap transactions are substantially less expensive than other trading methods via a CEX because they do not involve middlemen. Fees for some layers and blockchains might be as low as a few cents.

Disadvantages of atomic pairs

1.Newness. Atomic swaps are still somewhat of a science fiction concept despite their potential. Many of the dApps and associated smart contracts have yet to undergo extensive testing for safety and scalability because the existing methods are still in their early stages. Additionally, the intrinsic complexity of atomic swaps hinders user uptake. To make the atomic switch procedure seem more approachable and less intimidating, developers will need to improve its user experience and design.

2.fewer pairs. Only a few atomic swap dApps for Bitcoin are available right now, and there aren’t many assets that work with them. Using a centralized exchange could be simpler depending on the assets a user wants to trade.

3.lack of trade in fiat money. Fiat-to-crypto and crypto-to-fiat swaps are not possible due to the blockchain’s atomic swapping technology. Users might, however, be able to exchange for Bitcoin stablecoins backed by money.

In conclusion, Although centralized exchanges can offer a user experience that is frictionless and comparable to traditional asset trading, atomic swaps offer superior degrees of security, immutability, and decentralization. With exchanges becoming more available and encouraging more cross-chain interaction, Web 3.0 technology will continue to advance.

The throughput and programmability of the Bitcoin protocol are constrained. As a result, when it comes to fostering a vast ecosystem of applications, Bitcoin needs rely on layered solutions far more than other top blockchains. A trustless swap mechanism like LNSwap that seamlessly connects the base and its layers is essential for Bitcoin. Users are then able to communicate with numerous decentralized applications and exchange for assets across several layers.