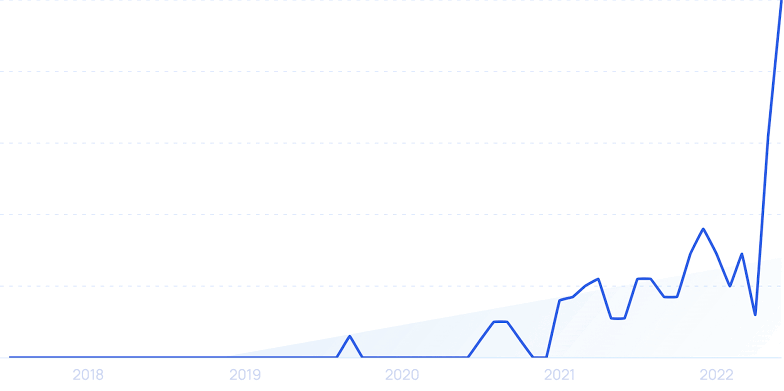

DefiLlama data shows that just two weeks ago, the total value of all assets locked on decentralized finance (DeFi) protocols was at its lowest point since February 2021. Now, it has surged to a three-month high of $42 billion.Rising asset prices and new entries from players looking to make money through lending and staking are the two main drivers of the DeFi market’s comeback.

The asset that supports most of the DeFi market, ether (ETH), has risen from $1,590 to $1,810 over the last two weeks. Meanwhile, other stocks, such as aave (AAVE) and lido (LDO), have posted gains of 25% and 34%, respectively.In tandem with an increase in asset values, the volume of transactions across DeFi protocols reached a record high of $4.4 billion on October 24, the highest since March, according to DefiLlama.

This month, the launch of Solana’s native staking product—which yields 8.15% APY in addition to its 7.7% rate on liquid staking—saw a 120% increase in total value locked (TVL) for Marinade, the company’s largest lending protocol.Jito, a rival protocol to Marinade, has increased by 190% to $168 million in TVL during the same time frame.On Ethereum, however, new inflows have been demonstrated by the fact that the capital on Enzyme Finance, Spark, and Stader has increased by 37% to 55%, exceeding the increase in asset prices.

This month, the recently launched layer one blockchains Sui and Aptos have also seen strong growth; TVL on Sui has increased from $34 million to $75 million.Thla’s increased activity has been a driving force behind Aptos, whose total TVL this month crossed the $75 million threshold.Even with a successful month, there are still risks in the DeFi space because a small decline in ETH’s price would result in significant on-chain liquidations.Presently, a $76.2 million position on Aave is scheduled to be liquidated in the event that ETH crosses $1,777, and over $100 million is scheduled to be liquidated in the event that the price drops by 20%.