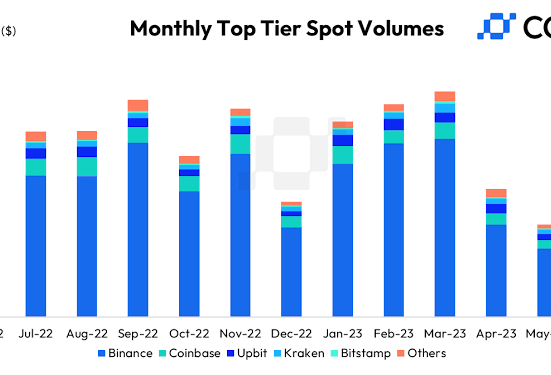

To prevent one from having an advantage, cryptocurrency fund manager Grayscale is pleading with the Securities and Exchange Commission to approve all proposed spot Bitcoin exchange-traded funds (ETFs) at once. Grayscale’s legal team filed a letter about eight spot Bitcoin ETF registrations, including its own, claiming the SEC shouldn’t pick “winners and losers” and should instead make a fair and orderly judgement, according to a post by Grayscale Chief Legal Officer Craig Salm on July 27. According to the letter, the SEC might approve the spot ETFs based on its approval of Bitcoin futures ETFs because the two fund types are “inextricably linked.” The most recent surveillance sharing agreements (SSAs) between Coinbase and the spot ETF providers, according to Grayscale, are “not a new idea” and would not comply with SEC requirements. SSAs with Coinbase have just been added to ETF filings from Invesco, BlackRock, Valkyrie, VanEck, Wisdom, Fidelity, and ARK Invest.In order for the SEC to keep an eye out for any potential market manipulation or erroneous trading activity, Coinbase will submit information about its trading books as well as other data. Due to the lack of SSAs, the SEC opposed the ETFs in late June, arguing that they were required due to the possibility of manipulating the crypto markets.The SSAs, according to Grayscale, “would neither satisfy nor be necessary” in accordance with SEC requirements because Coinbase is neither registered with the SEC as a securities exchange or broker-dealer nor with the Commodity Futures Trading Commission as a futures exchange. It was stated that allowing the ETFs would “improperly grant these proposals an unfairly discriminatory and prejudicial first-mover advantage” and represent “a positive but sudden and significant change” in how the SEC applied its standard.According to Salm, the Grayscale Bitcoin Trust (GBTC), which tries to monitor Bitcoin’s price, has close to 1 million investors. There is “simply no reason” the SEC should prevent GBTC investors from purchasing a spot Bitcoin ETF, he added, adding that if it were converted to an ETF, investors would receive billions in value back.In June of last year, the SEC rejected Grayscale’s request to change the GBTC into a spot Bitcoin ETF. In response, Grayscale filed a lawsuit against the regulator, claiming that by refusing to treat comparable investment vehicles consistently, it was acting arbitrarily.