The proprietary Bitcoin Greed & Fear Index from cryptocurrency services firm Matrixport, which has a good track record of predicting trend reversals, is indicating a bullish recovery in bitcoin (BTC).

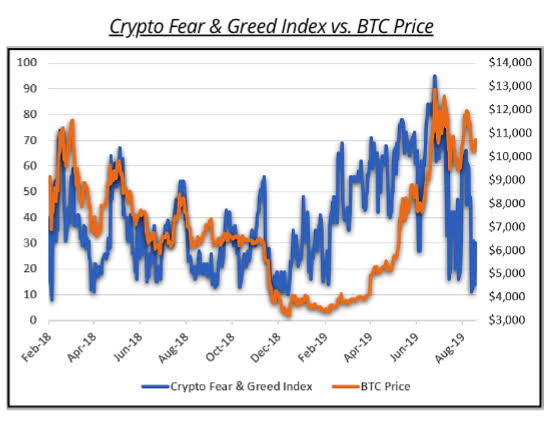

Investor sentiment is gauged by the Greed & Fear Index. values below 10% signify extreme fear or pessimism, while values above 90% indicate excessive greed or optimism. Such indicators are closely monitored because excessive optimism or greed are frequently observed during market peaks, whereas dread is typically observed at market troughs.

According to data, Matrixport’s index recently moved higher from 30% to 60%, bottoming out following its decline from above 90% in July.

“The daily signal (grey) is projecting upward pressure, suggesting that the index has bottomed out. The climb in bitcoin prices may restart after four weeks of consolidation, according to Markus Thielen, head of research and strategy at Matrixport, in a letter to clients on Thursday.

Take note of how past tops and bottoms in the index and its 21-day simple moving average, or SMA, have matched up with bullish and bearish price reversals for bitcoin. Now that the 21-day SMA appears to have bottomed out, the case for increased upside volatility in bitcoin is strengthened. With typical market volatility and anticipation of Federal Reserve interest rate cuts early next year, Bitcoin has been stagnant for a while, ranging between $28,000 and $30,000 for more than two weeks.

A key driver of price volatility, in the opinion of some analysts, is the U.S. Securities and Exchange Commission’s impending decision on whether to authorise a spot exchange-traded fund.

Although some analysts anticipate a swift decision, the regulator has until Sunday to decide whether to approve or reject Ark Invest’s application for a spot bitcoin ETF.