Analysts call for an update of SEC norms, citing licensing barriers for Nigerian exchanges.

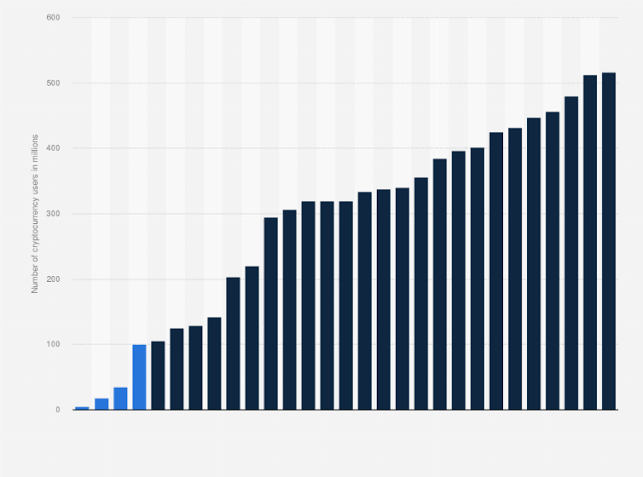

Rume Ophi, a Nigerian crypto analyst, believes that the virtual asset services providers (VASP) criteria should be reviewed by the Nigerian Securities and Exchange Commission (SEC) in order to make it easier for local crypto exchanges to obtain licenses to operate in the nation.In an interview with Cointelegraph, Ophi clarified that local cryptocurrency exchanges should have been given priority when creating the SEC’s current guidelines, which are meant to direct the registration of VASPs but do not support them.Exchanges have to meet the conditions for application processing, pay a registration fee, and pay any other necessary costs in order to receive a VASP license from the SEC. Ophi clarified that many local exchanges are unable to meet the 500 million naira ($556,620) minimum upfront capital requirement. As a result, he predicted that international exchanges will dominate the Nigerian exchange market rather than a stable balance. Nigerian Web3 lawyer Kue Barinor Paul, who backed Ophi’s position, stated in a recent conversation on X that Nigerian crypto exchanges and VASPs would probably need to combine in order to meet the SEC license criteria.According to Paul, the existing system for license registration by the Nigerian SEC has to be revised because it primarily benefits international exchanges. The Nigerian Securities and Exchange Commission released a 54-page paper titled “New Rules on Issuance, Offering Platforms and Custody of Digital Assets” in May 2022.In addition to providing instructions on how Nigeria’s banks and financial institutions can deal with digital assets, the paper opens doors for bitcoin service providers operating in the nation.Ophi added, “To make sure that the SEC’s licensing requirements are in line with the current realities of the country’s economy, the Nigerian National Assembly needs to get involved.” Nigeria, the biggest economy in Africa, has the highest degree of cryptocurrency awareness globally, according to a global poll comprising participants from 15 countries.Out of 154 nations evaluated, Nigeria ranked second in terms of cryptocurrency adoption, according to Chainalysis’ “2023 Cryptocurrency Geography Report.”It was projected that the country’s high level of cryptocurrency acceptance will draw more foreign investment in the space.Ophi, however, blames the low investment rate on the recent lifting of the prohibition on banking institutions handling cryptocurrency exchanges.