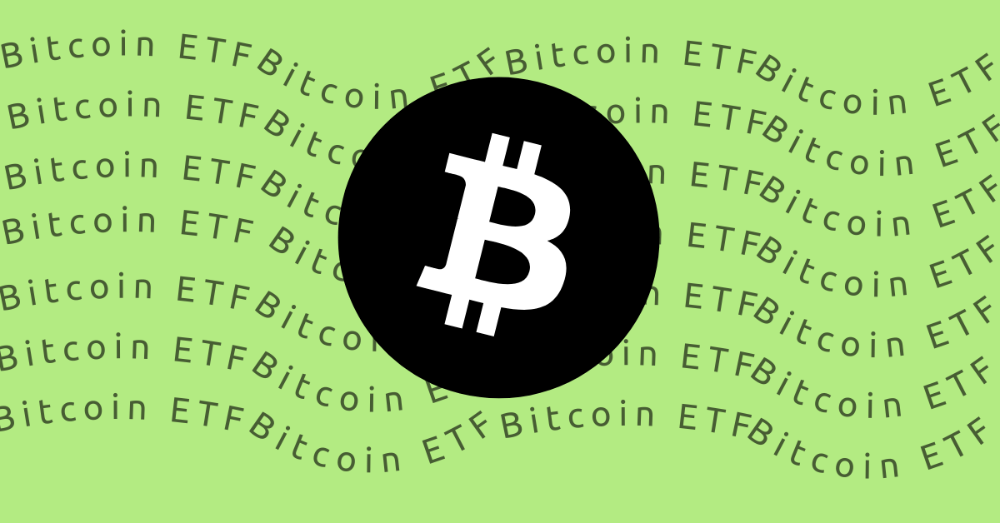

Prediction for Bitcoin Price as it Drops to $42,000 Level: Is It Time to Invest in the Dip?

The price of bitcoin drops to $42,000 on Sunday and is presently trading at $42,588. This represents an almost 0.60% reduction. The question of whether now is the perfect moment to purchase the dip is one that both fans and investors are asking in light of the recent volatility in the value of Bitcoin. A