Three Democratic senators wrote a letter to Jerome Powell, the chairman of the Federal Reserve, on Monday stating that the Fed has held interest rates too high for too long and that a reduction is necessary. “Today, we write to the Federal Reserve (the Fed) pleading with them to lower the federal funds rate from its present, twenty-year high of five percent. Senators Elizabeth Warren (D-Mass.), Jacky Rosen (D-Nev.), and John Hickenlooper (D-Colo.) warned that “this sustained period of high interest rates is already slowing the economy and is failing to address the remaining key drivers of inflation,” as per a document on the HuffPost website.

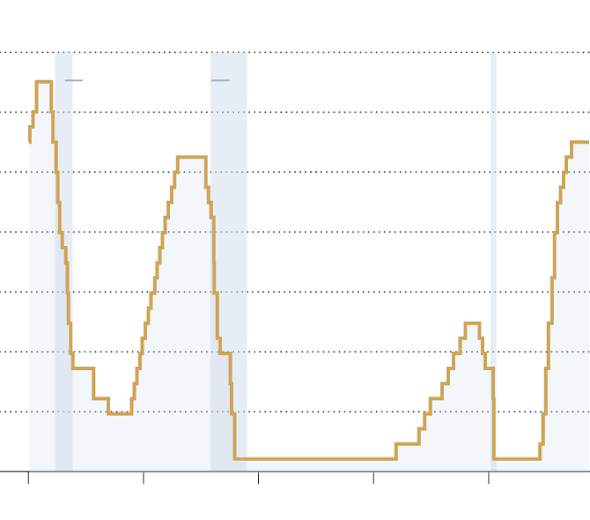

Financial markets moved back expectations for the first 25 basis-point interest rate decrease from July to September in reaction to the surprisingly strong labour market. The increase of bitcoin (BTC) has been halted by the hawkish repricing.

The senators contend that the high interest rates intended to control inflation exacerbate the issue by driving up the cost of building, housing, and auto insurance, as well as increasing the possibility of an economic downturn that may “push thousands of American workers out of their jobs.” Higher interest rates are driving up rent, according to analysts at investment banking behemoth JPMorgan in April.

The senators declared that the Fed should abandon its 2% inflation target and instead take a cue from the European Central Bank. Last week, the ECB and Bank of Canada lowered interest rates, defying the Fed’s higher-for-longer policy. The letter states that the disparity may result in tighter financial conditions or credit flow through different economic sectors as well as a higher dollar.

Economic downturns are frequently caused by tighter financial conditions. The discrepancy is not expected to persist long, according to Singapore-based cryptocurrency trading firm QCP Capital, which views the decline in the price of ether (ETH) and bitcoin as a buying opportunity.