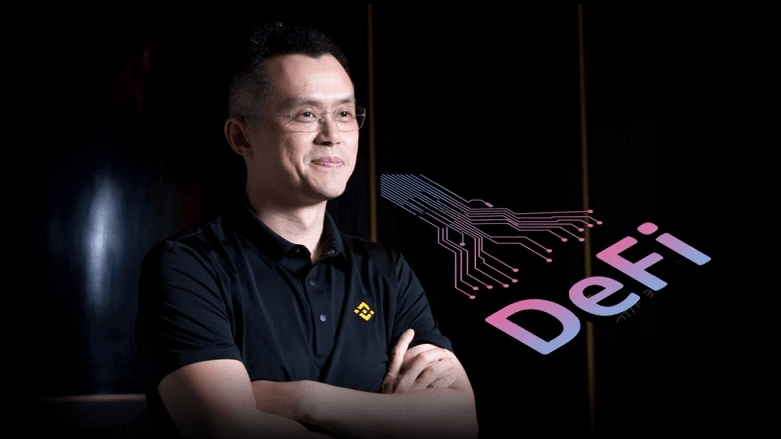

Changpeng “CZ” Zhao, CEO of Binance, believes that during the upcoming bull run, decentralized finance (DeFi) may outperform centralized finance (CeFi).Zhao discussed his views on the future of DeFi at a live X Spaces (formerly Twitter Spaces) AMA on September 1.He proclaimed, “I think the more decentralized the industry becomes, the better,” and said it might not be long before it overtakes CeFi trading volumes.

“DeFi is the future; the volume is somewhere between 5% to 10% of CeFi volumes, which is not small right […] the next bull run may very well make DeFi bigger than CeFi.”

The top three decentralized exchanges (DEXs) saw a 444% increase in median trading volume in just 48 hours after the United States Securities and Exchange Commission (SEC) filed suit against centralized exchanges Coinbase and Binance on June 9.At the time of publication, DEXs had a $722,776,226 24-hour trading volume.The recent dismissal of the lawsuit brought against the decentralized technology Uniswap was also discussed by CZ. “The Uniswap thing was extremely positive, extremely reasonable, logical and clear. That is very good,” he declared.

Plaintiffs who claimed they lost money as a result of scam tokens on the decentralized cryptocurrency exchange filed a class-action lawsuit against Uniswap and its CEO, foundation, and venture capital investors. The lawsuit was dismissed by a U.S. federal court on August 30.Due to the inability of either party to identify the con artists, the judge dismissed the case and underlined how regulatory uncertainty weakens investor protection.

“They now sue the Uniswap Defendants […] hoping that this Court might overlook the fact that the current state of cryptocurrency regulation leaves them without recourse.”

An X user mentioned the judge’s ruling that developers are not responsible for the improper use of a DeFi platform during the session, which the user believes is good news for DeFi architects.More industry protection, according to CZ, is a good thing.

“Developers writing code, that code is free speech. So the development is really good,” CZ stated.

Recent data suggests that investors are increasing their investments in DeFi initiatives by reallocating money from CeFi projects.Investing in DeFi projects increased 190% from 2021 to $2.7 billion in 2022, according to a CoinGecko analysis released on March 1. Investments in CeFi projects decreased by 73% to $4.3 billion during the same period.

This “Potentially points to DeFi as the new high growth area for the crypto industry,” the report stated, adding that the decrease in funding toward CeFi might stem from the sector reaching a saturation point.