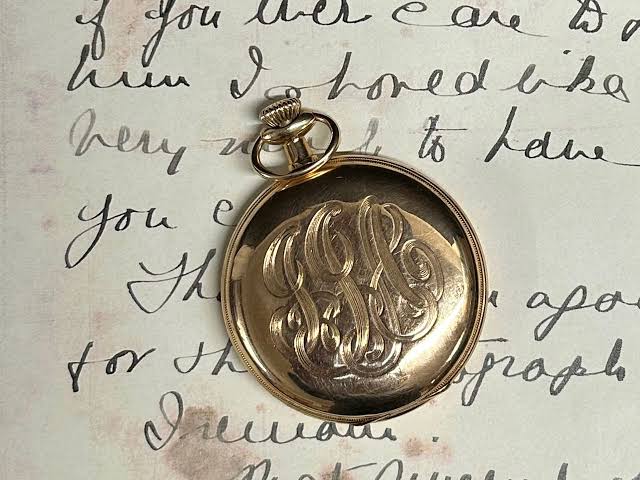

Ex-head of FTX Europe pays $1.5 million for a gold watch that was found on the Titanic.

A gold pocket watch found inside the body of the richest passenger on the Titanic was purchased by Patrick Gruhn, the former chairman of FTX Europe, for about $1.5 million, “the largest sum ever spent at auction on a piece of Titanic memorabilia,” according to The Wall Street Journal. John Jacob Astor IV, an American