Final Regulation of Crypto and Stablecoin Proposals Published in the U.K.

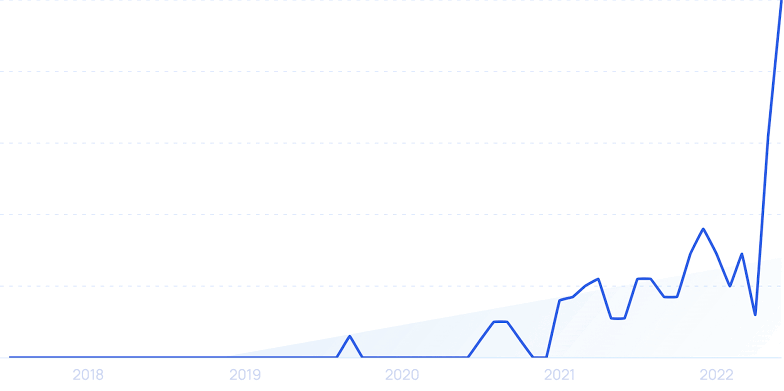

The final regulations for the cryptocurrency ecosystem were released by the U.K. government, which stated that regulations will be implemented gradually and that early in 2019 legislation pertaining to fiat-backed stablecoins will be introduced.An update released on Monday states that as the government incorporates lending and trading into the purview of traditional financial regulation, other crypto domains, like algorithmic stablecoins, will follow.These regulations will place pertinent activities under the Financial Conduct Authority’s (FCA) jurisdiction. The plans are expected to be well received by the industry, which has been complaining that the government has been slow to act. The plans are in line with an April 2022 policy set out by Rishi Sunak, the then-finance minister and current prime minister, to make the U.K. a hub for cryptoassets. In a statement accompanying the document, Treasury Minister Andrew Griffith said he was “very pleased to present these final proposals for cryptoasset regulation in the U.K.” The finalized framework would mean “the U.K. is the obvious choice for starting and scaling a cryptoasset business.” The government’s financial branch, the Treasury, released a crypto consultation in February, and it ended in April.The Financial Services and Markets Act 2023, which was approved by Parliament in June, allows cryptocurrencies to be regarded as regulated businesses.Although Griffith has now modified some of his proposals clarifying the treatment of cryptoassets it already considers traditional financial instruments as well as non-fungible tokens (NFTs), the government has already stated that it wants to bring crypto within the purview of traditional financial service regulation. “The proposed regime does not intend to capture