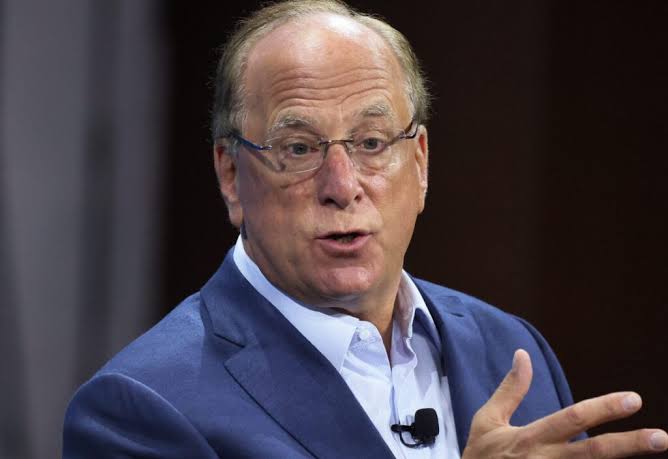

According to BlackRock CEO Larry Fink, he hasn’t given thought to where Bitcoin’s price might go and that it might not replace fiat money for regular purchases. As he reiterates that Bitcoin should be viewed by the public as primarily an asset class, BlackRock CEO Larry Fink questions the viability of utilising it for regular transactions.

Fink expressed his support for Bitcoin in a CNBC interview on January 11, saying he sees it more as a substitute for national currencies than as a means of storing wealth.

“I don’t believe it’s ever going to be a currency. I believe it’s an asset class.”

He does think that central bank digital currencies, or CBDCs, will become a reality soon, though.

“I believe that we will employ technology to develop digital currency. “We intend to employ a blockchain,” he declared.

Based on current statistics, more than 100 nations are investigating the creation of CBDCs, and 39 nations have either started CBDC efforts or are in the process of developing a pilot or proof-of-concept project.

However, Fink stated that price wasn’t his top worry at the moment when asked about his thoughts on ARK Invest CEO Cathie Wood’s most recent Bitcoin valuation projections, which ranged from $600,000 to $1 million.

Fink replied, “I haven’t even thought about it,” indicating that he hasn’t made it a major priority to provide “an instrument that can store wealth” through its recently authorised spot Bitcoin exchange-traded fund (ETF).

“I believe that gold will represent an even greater value if it ever approaches that high. To be clear, there will be a comparison between Bitcoin and gold if you believe it to be digital gold.

Fink clarified that the Bitcoin ETF will help legitimise a sector that has been met with scepticism from the start in a different interview with Fox Business that same day. He said, “We’re legitimising it; we’re creating more safety with the introduction of the Bitcoin ETF.”

This comes after it was announced on January 10 that the US Securities and Exchange Commission had given the go-ahead for BlackRock’s spot Bitcoin ETF application as well as ten others to be launched in the US. BlackRock has a record of 576 ETF approvals to just one rejection since its Bitcoin ETF approval.