Offering its yield-bearing USYC token through Copper, the cryptocurrency custody firm chaired by former UK Chancellor Philip Hammond, is Hashnote, a decentralized finance (DeFi) startup catering to compliance-conscious institutions. With Chicago-based trading firm Cumberland as a market maker, Hashnote is the first cryptocurrency startup to come out of Web3 incubator Cumberland Labs.Hashnote’s USYC is now available to the 300+ major institutions and cryptocurrency trading platforms that the custody service serves thanks to an interface with Copper.

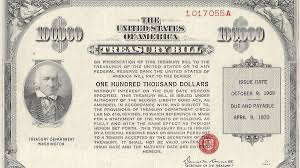

As the movement toward institution-friendly tokenization in the cryptocurrency space picks up steam, blockchain-based renditions of US Treasury bonds as well as products like yield-bearing tokens and stablecoins have gained popularity.But according to Hashnote CEO Leo Mizuhara, not every tokenized Treasury-type offering on the market is made equal.

“People are treating these on-chain treasuries as if they were as safe as something you’d see in normal finance, like a money market account,” Mizuhara said in an interview. “But different structures matter a lot; it’s not the same as being in a money market fund when you are in an SPV [special purpose vehicle] that owns Treasuries, for example, or an SPV that owns ETFs [exchange traded funds].”

According to Mizuhara, the USYC token from Hashnote has a net yield of roughly 4.8% and is based on the reverse repo, which is the practice of holding Treasury Bills overnight with a guaranteed price the next day.

“Not everyone gets access to the reverse repo window,” said Copper’s head of sales Michael Roberts in an interview. “That really is the mainstay of the big banks and some broker-dealers. Longer term, we’re working on a deeper integration where the token can persist and potentially be used as collateral as well.”