Blockchain has pushed for years to be recognised as a major emergent technology, and it is now beginning to do so. Numerous sectors are already utilising the technology, and notable use cases are constantly emerging. It is not unexpected that many believe the financial services industry would be where blockchain technology has the most influence given that the technology’s original goal was to provide a superior alternative to the current financial system. Decentralised finance (DeFi), the hottest blockchain trend of the year, is another indication of how well-liked the technology is becoming.

The technology has been quietly advancing in a variety of other sectors, including supply chain management, healthcare, entertainment, and retail, even though blockchain has, maybe rightfully, been hogging the spotlight with its financial applications.

In this article we’ll talk about how Blockchain is used in real estate and the benefits of implementing blockchain in real estate.

How is blockchain used in the real estate industry?

Here are a few specific applications of blockchain in the real estate industry

1..Managing assets and funds: Keeping track of everything can be difficult, particularly when a real estate investor has a sizable portfolio or a complex ownership structure. Keeping an accurate ledger of the money coming into and going out of the system is just as crucial as maintaining an accurate balance sheet. A ledger for such specific purposes might be on the blockchain. Real-time auditing and transparency are both available. In addition, it cannot be changed unilaterally by a single entity because it is immutable.Additionally, a native digital currency that is utilised in asset leases as a form of payment can be recorded on the same ledger.Utility bills can also be paid using the digital money, and the process can be automated using smart contracts.

Indeed, lease negotiations and rent payments can be automated using smart contracts on the blockchain. Additionally, real-time data from the blockchain can be utilised to inform important decisions about asset management.

2. Finance for projects: Real estate developments are frequently huge. Almost no one organisation can afford to finance their development. In such circumstances, many parties may supply the necessary funding, posing a management issue.

Financing arrangements may be managed, secured, and automated thanks to the blockchain. The blockchain enables smart contract-based tools for stakeholders to directly participate in the project’s management, such as through Decentralised Anonymous Organisations (DAOs), in addition to offering a common ledger for monitoring stakes.

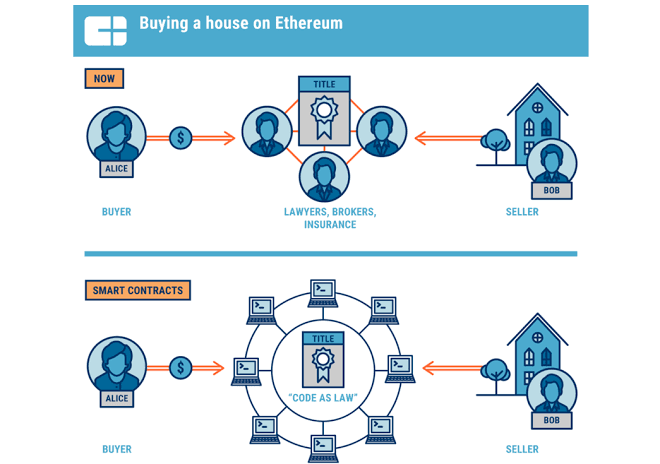

3.Property and land registries: Democratic societies are based on the concept of property ownership. That specifically means being able to prove and secure it with ease and certainty. The property registry, often known as titling systems, is used to do this.

Real estate ownership is, however, just as secure as the land register. others in positions of power have the ability to evict others without it if the system is nonexistent or readily subverted. Additionally, property ownership can be changed at will in weak land registers. This can make investing in real estate both very hazardous and appealing. Cryptography, immutability, and decentralisation are advantages of a blockchain-based land register, making arbitrary changes challenging to implement. Titles may exist as non-fungible tokens (NFTs) on the blockchain.

4.Identification of investors and tenants: In real estate deals, identity is crucial. The owner of the asset must be verified before renting to or purchasing it, therefore the tenant or buyer must be informed. It’s critical that a landlord is aware of the tenant’s real name.Centralised databases provide access to this knowledge. The data, however, can be more precise if it is saved in a way that guards against potential tampering.

5. Tracking and confirmation of real estate transactions: To start and complete a transaction, investors, agents, brokers, and other real estate experts frequently employ many siloed systems. Due to the fact that the due diligence procedure is largely manual and paper-based, each step might take a long time. Beginning with the property search process, the blockchain has the potential to enhance the current methods. A property owner can use a private key to prove ownership of a record on the blockchain.

Anyone who is considering purchasing, leasing, financing, or engaging in any other activity can quickly check the immutable ledger to confirm ownership and to look up previous transactions, including whether the property has any liens.

Benefits of Implementing Blockchain Tech in Real Estate

1.Data transparency and availability: Many parties are frequently involved in the transaction and management of residential or commercial real estate properties. Owners, tenants, property managers, lenders, investors, and agents may be on the list.These stakeholders now have the chance to audit transactions in real time thanks to blockchain technology. Each has easy access to information that can guide their actions. For instance, based on rentals, occupancy, and expenses, owners can develop financial models. Immutability, cryptography, and decentralisation of the blockchain strengthen the security and integrity of the data.

2.Blockchain makes fractional ownership possible: On the blockchain, assets can be tokenized and their ownership split among numerous parties. Depending on what portion of the asset they own, these co-owners may get proceeds or pay a portion of any overhead. Processes are currently controlled by blockchain smart contracts.

3.Investments in commercial property: Due to the ease with which small investors may purchase tokens that represent a portion of real estate on the blockchain, even they can now acquire a stake in major real estate projects.

4.Real estate assets are tokenized: Assets may become more widely available if they are tokenized. For instance, it is feasible to tokenize such a project so that, even while it stays as a single entity physically, stakeholders nevertheless retain portions of it in the accounting records based on their capital contributions.

In conclusion, the power of blockchain in real estate may be used in a variety of ways to the advantage of the real estate sector, as we have shown so far. Real estate requires dependable systems to ensure that the industry is in excellent condition because it plays such a significant role in the overall economy. At the same time, innovative concepts and methods can significantly help to revive a sector that appears to have achieved its peak of development.