Cryptocurrency traders are effectively using triangle arbitrage, a trading strategy that allows them to profit from price differences of digital assets across multiple platforms. Although it is a complex strategy requiring a sophisticated skill set, the use of bots streamlines the process. A triangular arbitrageur detects irregularities in the market and executes concurrent trades across three asset pairs while skillfully controlling risk.

What is arbitrage?

Arbitrage is a financial strategy where traders simultaneously buy and sell the same digital asset on different platforms to profit from price discrepancies. Market inefficiencies and varying demand-supply dynamics create these price discrepancies for the same assets across different platforms. For instance, the cost of Polygon’s MATIC may slightly differ on Uniswap and PancakeSwap.

Traders using this strategy, known as arbitrageurs, meticulously analyze these price disparities, buying low in one market and selling high in another to generate profits. Arbitrage presents a lucrative opportunity for investors.

What is triangular arbitrage?

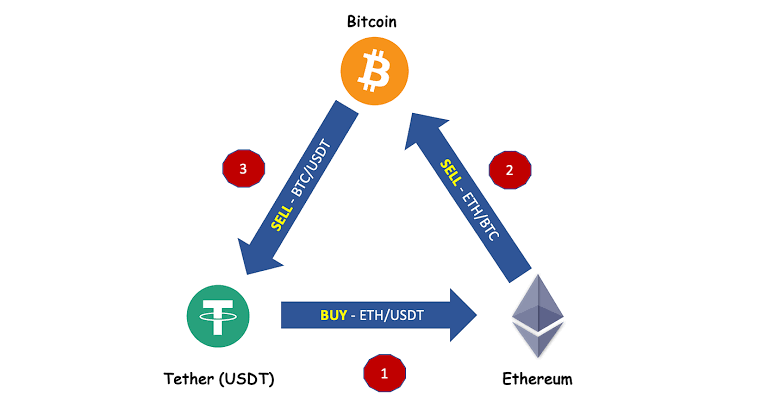

A triangle arbitrage method is used in cryptocurrency trading to take advantage of price differences between three distinct cryptocurrencies. The procedure entails exchanging one cryptocurrency asset for another as long as there are price differences between the assets on various exchanges.

In order to effectively implement the triangular arbitrage strategy, the trader must possess the ability to identify abnormalities in the market, execute trades simultaneously across multiple asset pairs, and effectively manage risk. In order to take advantage of triangular arbitrage opportunities, traders need to act fast due to the cryptocurrency market’s rapid price fluctuations. Depending on the prices of the three cryptocurrencies, the trader could employ different kinds of strategies. For example, they could use buy-sell-buy, buy-buy-sell, or sell-sell-buy to profit.

It takes a sophisticated skill set to recognise the opportunity for arbitrage and apply the appropriate strategy. Since the price difference between different cryptocurrencies may be small, traders often need to complete several cycles to earn a significant profit.

Benefits of triangular arbitrage

Triangular arbitrage offers several advantages to traders

1.More transparency:Trading activity in cryptocurrency marketplaces increases when three different trading pairs participate in triangle arbitrage. Increased market liquidity adds depth to a crypto market, facilitating large buy and sell orders of cryptocurrency assets. Moreover, enhanced liquidity makes it easier to execute significant trades without causing substantial price fluctuations.

2.Increased market capability:Triangle arbitrage helps identify and correct pricing imbalances in the market, just like other arbitrage techniques. By actively exploiting these disparities, traders unintentionally enhance market efficiency and stabilize prices, creating a level playing field for all participants

3.Greater potential for profit: Triangle arbitrageurs have greater potential to profit than traders restricted to single marketplaces. By skillfully identifying and executing triangle arbitrage trades, traders can benefit from pricing differences across many currency pairs as well as market fluctuations.

4. Risk mitigation: By spreading risk across multiple assets, triangle arbitrage helps cryptocurrency traders reduce their exposure to a single currency’s volatility. In the highly volatile cryptocurrency markets, the diversification strategy lessens the impact of sudden price swings. However, cryptocurrencies bring their own unique set of risks, such as a lack of regulatory clarity and sharp price changes. An arbitrage trader should be capable of handling these risks efficiently.

Downsides of triangular arbitrage

Here are some risks cryptocurrency traders have to deal with when using triangular arbitrage:

1.Liquidity risk:Insufficient market liquidity or a limited number of digital assets traders can hinder the execution of all trades necessary for completing a triangular arbitrage. If assets cannot be bought or sold at desired prices, traders risk incurring losses due to this lack of liquidity.

2.Market efficiencies:While triangular arbitrage offers potential profitability in ideal scenarios, traders grapple with uncontrollable factors that can disrupt trade timing. These factors encompass stock market inefficiencies causing execution delays and market volatility triggering price fluctuations before transactions are completed.

3.Slippage risk:Triangular arbitrage involves high-frequency trading when opportunities arise, making it particularly susceptible to slippage risk. Slippage refers to the discrepancy between the intended trade price and the actual execution price, often occurring in rapidly moving cryptocurrency markets.

Due to the time-sensitive nature of triangular arbitrage involving multiple trades, the prices and spreads between currencies can shift before a trader manually completes the final trade. This dynamic can lead to diminished profits or even losses

In conclusion,Fast-paced technological innovations and consequent developments in financial markets are capable of modifying the triangle arbitrage environment in unanticipated ways. In the foreseeable future, nevertheless, trading are likely to grow more sophisticated, precise and efficient.

A rise in competitiveness will make it more difficult to generate a profit if triangle arbitrage gains traction in the digital asset market. Triangular arbitrage gains may also be impacted by modifications to the monetary and regulatory frameworks in different countries. In order to take advantage of triangle arbitrage chances as cryptocurrency markets change, traders must be adaptable and quick in this fast-paced financial world.